Accounting may not be as glamorous now compared to pre-computer years, but it still has its moments. For self-employed accountants, they know that most anything could be put in the books, as long as the government regulations will allow.

Accounting may not be as glamorous now compared to pre-computer years, but it still has its moments. For self-employed accountants, they know that most anything could be put in the books, as long as the government regulations will allow.

For instance, cigars. Even the most expensive cigars can be tax-deductible. It’s only a matter of spending a little more and putting a ring with your name on it. In that way, it now becomes and advertising expense. This logic can be carried on with other such materials, including office supplies, school supplies, and so on. For large expensive items, these could be put in the books as expense accounts. For instance, a computer does not have to be an office equipment which would be depreciated over three or five years. Put it up as part of a project cost, as a one-time expense account. Because it is a project cost, you would have to have separate books for the project. In addition, the project would have it’s own revenue. The computer is already deducted as a one-time cost, and no need to depreciate over it’s lifespan.

This is not a matter of fixing the books. This is a matter of following accepted accounting practice. The only other rule is to treat the same items the same way, even for different years. If you are to change your accounting practice, just make sure that you don’t do that every year.

One other way to save, and turn it around as a benefit, is the use of tax saver private health insurance. This is just signing up for health insurance and adding it into the books as a company expense. This can be a perk or benefit, but what it does is it increases your expenses and lowers your taxable revenue.

There is no need to be creative about accounting. The rules are there to be followed. It would be a matter of interpretation, and how you interpret the rules. Bottom line is that your employees would benefit, and your company would have a better bottom line.

When you start to see varicose veins forming on your lower leg, you might just want to scrape them all out. If the problem worsens, then it becomes more difficult to remove. The good thing is that there are a lot of options available if you want to treat the problem. This article will discuss some of the possible solutions to treat this problem and the estimated overall cost.

When you start to see varicose veins forming on your lower leg, you might just want to scrape them all out. If the problem worsens, then it becomes more difficult to remove. The good thing is that there are a lot of options available if you want to treat the problem. This article will discuss some of the possible solutions to treat this problem and the estimated overall cost. .jpg) It’s no secret that even though business is getting better, everyone’s still feeling the effects of the recent economic crash. Across the USA and parts of the EU, people are still struggling through trying times and a lack of jobs. But it’s not all bad; there has been growth in various sectors of the business industry. While they aren’t traditionally considered big business; their rise is something to look out for in the future. So, before you start freaking out about the end of the economic world, look at these different sectors that show the

It’s no secret that even though business is getting better, everyone’s still feeling the effects of the recent economic crash. Across the USA and parts of the EU, people are still struggling through trying times and a lack of jobs. But it’s not all bad; there has been growth in various sectors of the business industry. While they aren’t traditionally considered big business; their rise is something to look out for in the future. So, before you start freaking out about the end of the economic world, look at these different sectors that show the

.jpg) Businesses keep track of their cash flow to make sure that everything is in budget. They monitor the money that goes in and out of the company to determine if they are earning or losing. Supplies are some of the expenses of a company. Building supplies such as those

Businesses keep track of their cash flow to make sure that everything is in budget. They monitor the money that goes in and out of the company to determine if they are earning or losing. Supplies are some of the expenses of a company. Building supplies such as those  As accountants, we tend to tell people that one of the best ways to cut their tax bills down is by giving to charity. It not only helps their pockets, it helps a good cause too. Under Australian law, if a business gives more than $2 to charity, as long as it is an approved one, that money is tax deductible. There are no claim limits and the only thing that isn’t allowed is to use charitable donations to create what is effectively a tax loss.

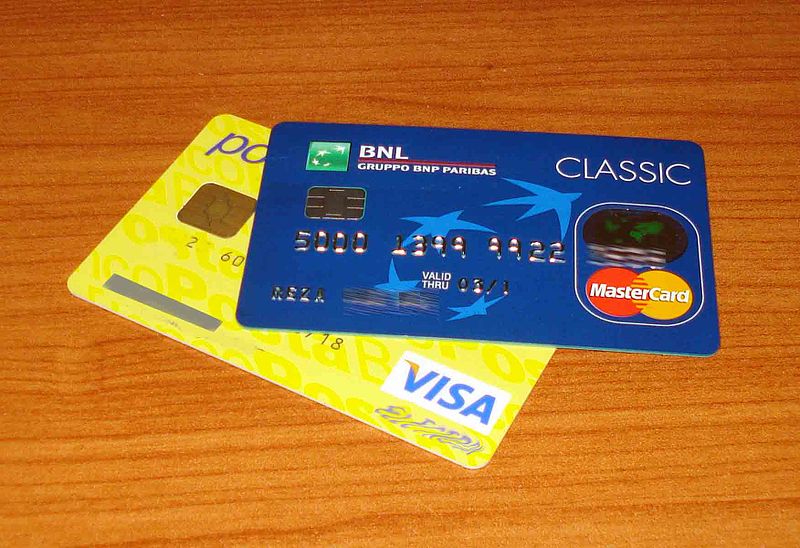

As accountants, we tend to tell people that one of the best ways to cut their tax bills down is by giving to charity. It not only helps their pockets, it helps a good cause too. Under Australian law, if a business gives more than $2 to charity, as long as it is an approved one, that money is tax deductible. There are no claim limits and the only thing that isn’t allowed is to use charitable donations to create what is effectively a tax loss. It is definitely tempting to splurge especially during summer season. It is the perfect time for traveling to different places or buying something new. Kids are on a class break and the entire family can have a get together moment any time. Thus, during this season, it might be very easy for you to take out your credit card and do whatever you want. However, if you want to avoid facing troubles later on, you have to make sure that you still manage your finances well. Here are some tips to avoid facing

It is definitely tempting to splurge especially during summer season. It is the perfect time for traveling to different places or buying something new. Kids are on a class break and the entire family can have a get together moment any time. Thus, during this season, it might be very easy for you to take out your credit card and do whatever you want. However, if you want to avoid facing troubles later on, you have to make sure that you still manage your finances well. Here are some tips to avoid facing  Whether you are using a mobile phone or a phone for your home or office, there are things you can do to

Whether you are using a mobile phone or a phone for your home or office, there are things you can do to  SIP trunking is now becoming popular in many businesses. A lot of business owners find this a lot better compared with traditional phone companies. SIP trunking is a flexible solution to communication issues. It is considered cheaper and of greater quality. It allows phone calls to be redirected from cables on a desk straight to your computer. Thus, despite simultaneous calls being made, the telephone bills to be paid are still low.

SIP trunking is now becoming popular in many businesses. A lot of business owners find this a lot better compared with traditional phone companies. SIP trunking is a flexible solution to communication issues. It is considered cheaper and of greater quality. It allows phone calls to be redirected from cables on a desk straight to your computer. Thus, despite simultaneous calls being made, the telephone bills to be paid are still low.  There are a lot of reasons for the government to build an actual toilet rather than portable toilets. After all, these toilets will last longer. However, the truth is that portable toilets may also be the more cost efficient counterpart especially for government that cannot really afford to construct toilets around the city. This article will prove that portable and rental toilets are much better in terms of overall cost.

There are a lot of reasons for the government to build an actual toilet rather than portable toilets. After all, these toilets will last longer. However, the truth is that portable toilets may also be the more cost efficient counterpart especially for government that cannot really afford to construct toilets around the city. This article will prove that portable and rental toilets are much better in terms of overall cost.  There are many different kinds of accounting, and most people aren’t aware that there are sub specializations in accounting. Much like doctors, there are general practitioners of accountancy and there are those who specialize in some areas.

There are many different kinds of accounting, and most people aren’t aware that there are sub specializations in accounting. Much like doctors, there are general practitioners of accountancy and there are those who specialize in some areas.